8 April 2020

Big Data & Predictive Analytics – Beyond the Buzzwords

Every business today needs one essential piece of kit: a crystal ball. If you could predict the future, risk and…

9 October 2017

Back in May, Forrester Research published a report titled ” The 2016 Guide To Digital Predators, Transformers, and Dinosaurs” which evaluated the digital competitiveness of businesses.

Predators are the firms that compete on the digital plane. Their go-to-market strategy is tied directly to the Cloud and emerging Internet of Things (IoT). They employ analytics to monitor their operations, customers, and markets; digital communications for coordinating activities with customers and partners; the Internet for e-commerce and subscription delivery; and the cloud for converting capital expenditures to scalable operational expenses that deliver cutting edge technology.

Transformers are companies that have more traditional business structures but which are quickly looking to adopt cutting-edge digital technology. They understand that business survival is based upon strategically realigning their processes via digital workflows.

The dinosaurs are the laggards. Digital dinosaurs are those firms too slow to adapt to the new competitive terrain. While they may adopt some digital practices, they do so too slowly to survive in the rapidly changing digital economy.

Traditional businesses and transformers are both starting from the same point, but the transformers are quickly adopting digital tools and processes. Forrester asked 435 executives to estimate the percent of total sales generated through digital products and services or associated with direct online sales. Digital mediation includes e-commerce, digital advertising, digital media, digital subscriptions, digital services, app sales, data sales, etc. Predators are currently generating eighty percent of their revenue digitally and aiming for ninety percent by 2020. Transformers and dinosaurs have limited digital sales processes (around fifteen percent of overall sales in 2015), but the dinosaurs are growing the percentage of digitally mediated revenue by only five percent per annum while the transformers are doubling this rate. Thus, in 2020, transformers will be earning close to two of every three pounds through digitally mediated transactions or digital delivery while dinosaurs will be generating only one in every three pounds through digital platforms.

[newsletter_lock]

Granted, if you are in the sales or marketing department, you are not designing these new products or digital platforms; but you can investigate how to leverage digital tools and platforms to improve the efficiency and effectiveness of your departments. There are a growing set of MarTech and SalesTech vendors looking to transform sales and marketing across the full customer pipeline. Scott Brinker of ChiefMartec.com has identified 3,500 MarTech vendors in his 2016 taxonomy. And that is before you start counting SalesTech.

At the very top of the sales funnel are vendors which support anonymous marketing to prospects which have yet to raise their hand and say, “tell me about your offering.” These services include website personalization, web visitor ID, intent data, and audience targeting.

A bit further down the pipeline are MarTech companies that focus on web forms, data enrichment, segmentation, analytics, lead scoring, lead routing, and messaging. At the heart of these activities is analytics and strong company and contact data. But companies are limited in their ability to directly maintain customer and prospect intelligence which is why firms should partner with third-party data providers to enrich their datasets.

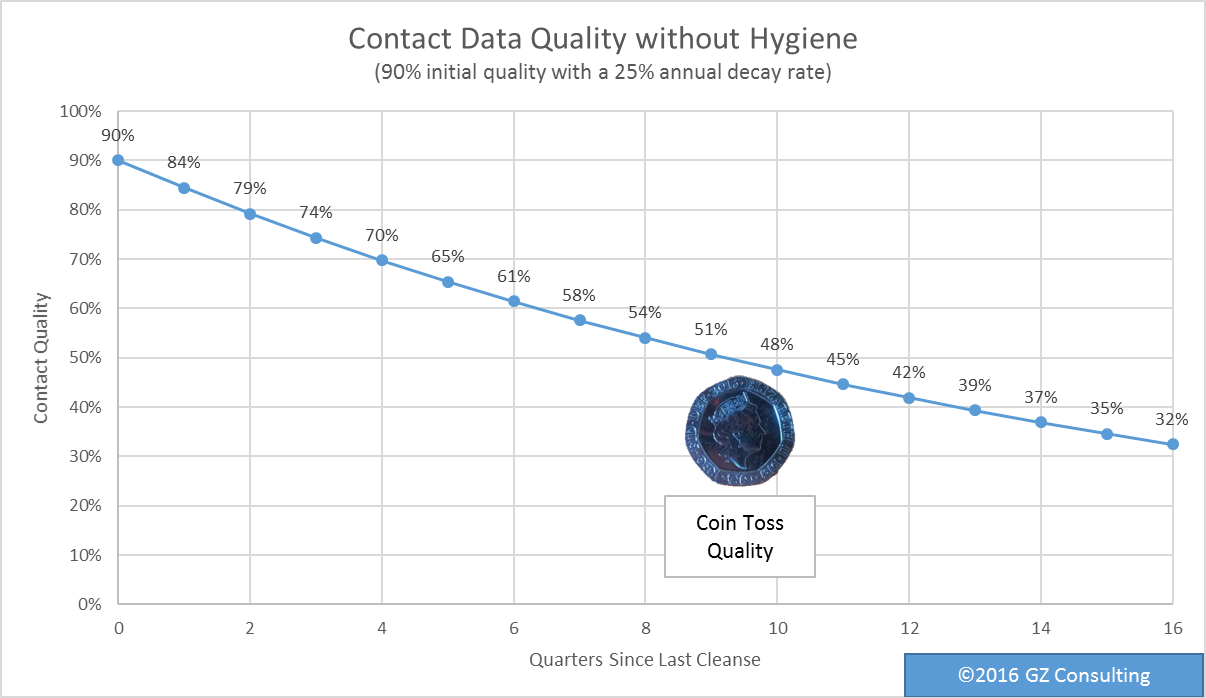

Once a record is keyed or uploaded into a marketing automation platform or CRM, it quickly begins to decay. NetProspex and others have pegged the contact decay rate at around twenty-five percent per annum. Thus a database that is ninety percent accurate today will be only 70% accurate after four quarters and will have coin flip accuracy after nine quarters.

It is therefore incumbent upon sales and marketing operations to solve this data quality problem by partnering with a data enrichment vendor that offers a reference database. The traditional approach of waiting until the marketing database has become rancid with bad data is no longer acceptable. Too many digital processes (e.g. lead scoring, segmentation, targeting, personalisation) are tied to the underlying data quality of your marketing automation and CRM datasets.

How can you properly segment your market if the biggest segment is UNKNOWN and there is no standardisation of key variables? How can you properly score and route leads if you don’t know whether the lead is from a new organisation or from a subsidiary or branch of a current account? How many leads are you failing to target because your marketing automation platform lacks reliable and complete firmographics?

Good company data is also necessary. While its decay rate isn’t as sharp, bad firmographics also severely hamper your marketing efforts.

And data quality problems are an even bigger issue when you consider the impact of bad company and contact data upon sales, service, fulfilment, and credit departments. Not only does marketing suffer, but bad marketing data is propagated to downstream platforms increasing the enterprise cost of bad data. Allowing bad data to hamper your marketing and propagate to downstream systems is digital malpractice. How many more incorrect decisions will be made when rotten and incomplete data are passed to other systems? How much more expensive will it be to clean inaccurate information passed downstream? The best approach to data quality is front-ending your systems with accurate, complete, and timely third-party enriched intelligence. Here is where sales and marketing can make a significant contribution to enterprise digital transformation.

Continuing down the pipeline to sales, one finds significant opportunities to leverage digital information as well. Improving the quality of leads passed from marketing to sales increases the confidence that sales reps have in these leads and the probability that they will quickly follow up on them. Furthermore, properly routing leads to the correct sales reps reduces sales channel confusion while accurate firmographics assist with prioritisation.

Once a sales rep begins acting on marketing qualified leads (or acting on leads they generated through sales prospecting against a high quality database), he or she can leverage sales intelligence to research accounts, identify additional contacts at customers and prospects, and determine account messaging. Furthermore, Social Selling services help track events at companies, providing ongoing insight to current customers and prospects. Alerts and integrated event feeds help reps prioritise their day, reach out with compelling talking points, and reassess deal close probabilities and timeframes.

So while you may not be in a position to drive the overall digital strategy of your organisation, you can certainly evaluate current sales and marketing processes for delivering accurate, complete, and timely sales and marketing intelligence.

[/newsletter_lock]